National Outlook

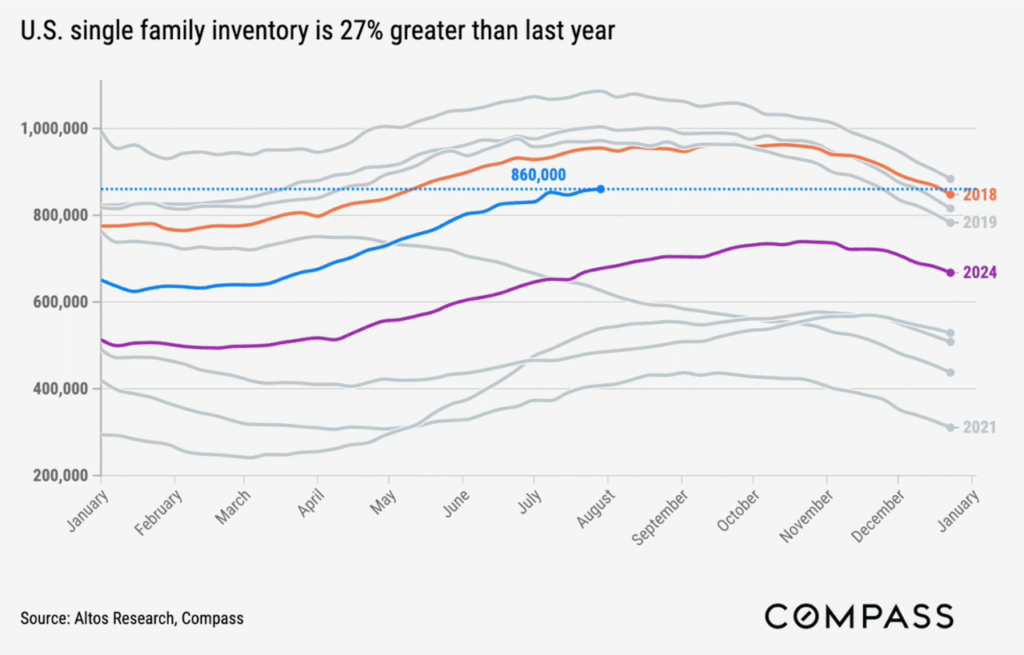

Mike mentions that the current unsold inventory is +37% YoY in California. But sales and pricing are holding up so we’re just getting used to having more active inventory laying around not selling.

Mike mentions that the current unsold inventory is +37% YoY in California. But sales and pricing are holding up so we’re just getting used to having more active inventory laying around not selling.

A recent report found 27% of all US homes sold in Q1 2025 were purchased by investors – the highest share in at least five years. That number was 18.5% between 2020 and 2023.

However, the number of homes bought is only a 1.2% increase YoY, showing that investors aren’t necessarily buying more homes this year, but there are less traditional buyers in the market and fewer sales overall.

What’s even more interesting is the vast majority of these investors (85%) are mom-and-pops, owning only 1-5 properties! Meanwhile, big investors shows a massive retreat as they sold 76% more properties than they purchased in Q1.

It seems both traditional homebuyers and the large institutional investors are slowing down and these smaller investors are taking advantage of it. After many years of bidding wars and rising prices, it seems now is a better time to purchase an investment property, especially if you’re looking to get a good deal and have the resources to put some work into the home.

Of course these numbers vary by area, so let’s look at California.

According to this article, three states dominate investor ownership, accounting for nearly 25% of all investor homes nationwide: Texas (1.66M), California (1.45M), and Florida (1.21M). However, this is purely according to volume which is unsurprising considering these three states are the most populous. Looking at the percentages, Hawaii and Alaska have higher shares of investor ownership with 39.9% and 35.5% respectively.

This article expands on how California counties with low populations, where second home ownership is more common due to tourism and recreational opportunities, have the highest percentage of investor-owned homes. These include Sierra County, with a whopping 82% of single-family houses owned by investors, Trinity County (77%), Mono County (74%) and Alpine County (68%).

Counties with major cities and more expensive real estate have more modest shares of homes owned by investors: San Diego, Orange County, Los Angeles, Santa Clara, and San Francisco all sit at only 15%.

Takeaway: San Diego real estate isn’t overrun by investors quite yet, but if you’re thinking of buying an investment property out of state where it’s more affordable, you’re not alone.

By Natalie!

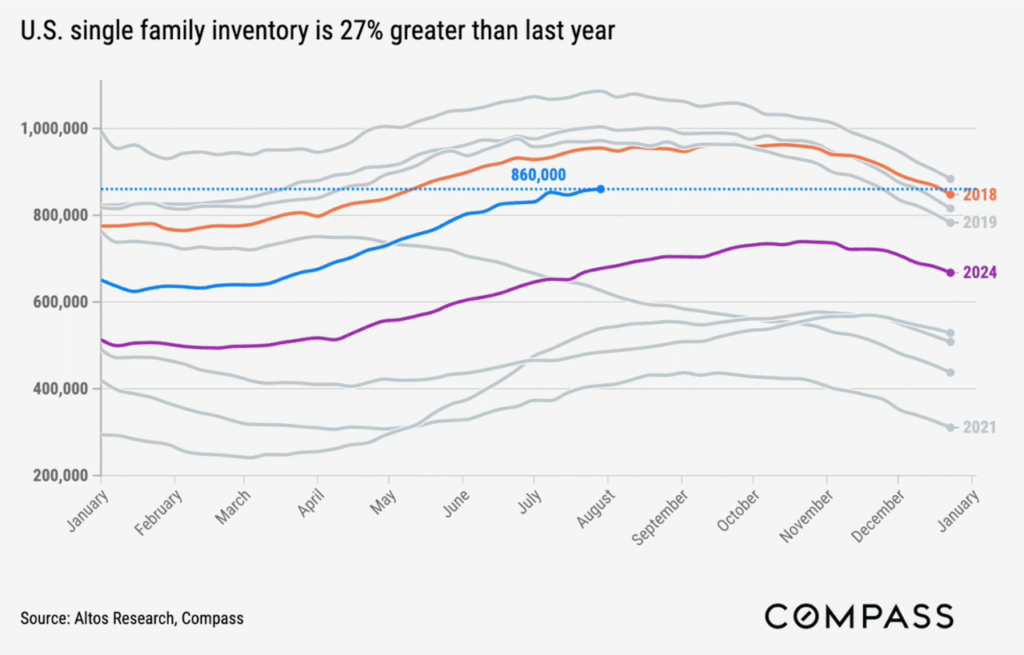

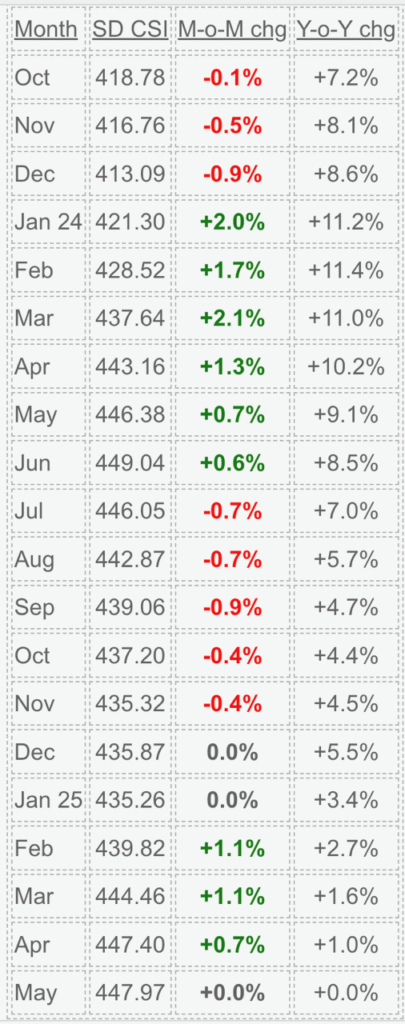

San Diego Case-Shiller Index, Non-Seasonally-Adjusted

The buyer enthusiasm in 2025 was about half of what it was in 2024.

The May reading is the first double-aught month, with both MoM and YoY logging in zeros, and it sure looks like it will be the peak of the year. Last June was the peak of all-time, and it could hold up if we don’t get a bump next month.

In the last half of 2024, the index lost 3.1%, and we’re probably heading for a similar drop this year – at best. It should set up the same first-quarter mini-frenzy in 2026 that we experienced at the beginning of 2024 and 2025.

“May’s data continued the year’s slow unwind of price momentum, with annual gains narrowing for a fourth consecutive month,” said Nicholas Godec, CFA, CAIA, CIPM, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices. “National home prices were just 2.3% higher than a year ago, the smallest increase since July 2023, and nearly all of that gain occurred in the most recent six months. The spring market lifted prices modestly, but not enough to suggest sustained acceleration.”

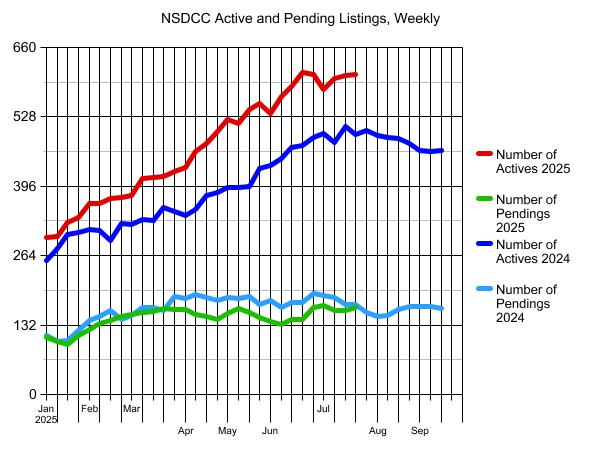

What we have is an extra ~100 active listings this year.

It hasn’t discouraged buyers or sellers, based on the statistics.

Here’s the YoY distribution by price range.

NSDCC Active Listings Compared to 2024:

0-$2,000,000: same

$2,000,000 – $3,000,000: +30%

$3,000,000 – $4,000,000: +19%

$4,000,000 and above: +15%

I thought the extra inventory would all be high-enders, but it’s the middle of the pack that is bulking up. But it’s not affecting the enthusiasm of new listings coming to market. Of the 46 new NSDCC listings in the last week, only 26% of them were refreshed listings (previously active/unsold in the last few weeks).

Buyers – hang in there and keep looking – you never know!

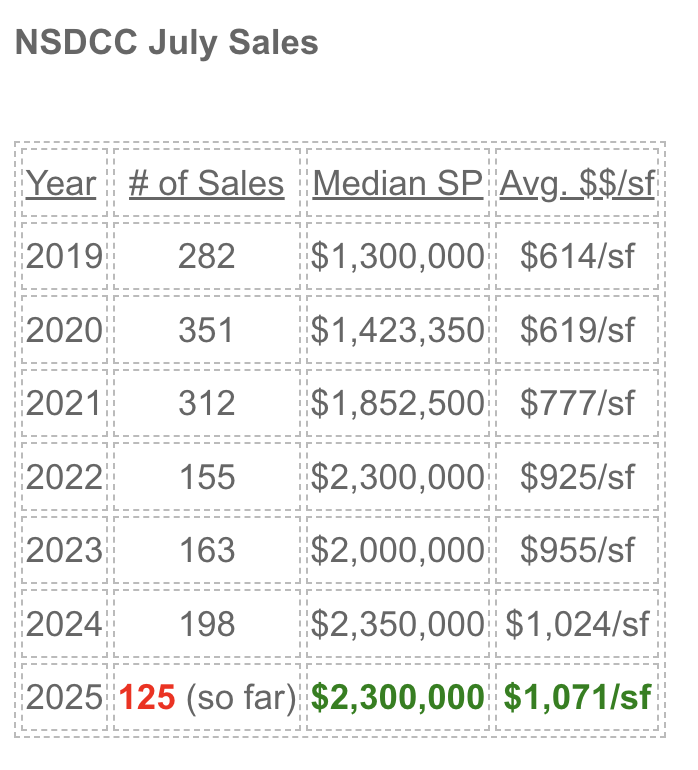

The pundits might make some noise about dropping sales but around here the pricing is holding up. Besides, the 2024 sales look like an outlier compared to the two previous years.

Fewer sales are a sign of patient sellers, and unless there is a bulk dumping on prices in the coming months, we’re just going to wrap up the year with the biggest load of unsolds…ever?

Tim is from Newport Beach so he’s taking some latitude here to see what’s acceptable around Carlsbad in 2025. He’s pretty funny but I haven’t seen much of the house:

Surrounded by majestic mountains and natural parks, the medieval city of Bragança in northern Portugal offers affordable living without sacrificing modern amenities. Home to 34,000 residents, Bragança boasts a private hospital, a modern shopping center, and furnished apartments for just $400 to $500 a month. Add another $150 for electricity, water, and internet, $30 for a transportation pass, $100 for private health insurance, and $400 for food, and a couple can live comfortably on $1,500 or less per month.

Meander along cobbled lanes, admire the 12th-century castle, and practice your Portuguese at the local mercado while picking up the freshest produce, meats, seafood, and artisanal products. Bragança is just the right size, where neighbors know each other, and every corner of the medieval streets tells a story.

Throughout the year, Bragança comes alive with festivals—from the Medieval Fair to cultural celebrations and religious holidays. Dining out is affordable, with mid-range restaurant meals costing around $15 and quick bites at cafés available for even less.

Outdoor enthusiasts will love leisurely strolls in the city’s parks or more challenging hikes in Parque Natural de Montesinho, a vast natural reserve in the nearby mountains.

Bragança has a continental climate, with hot, dry summers reaching 86°F and cold, wet winters, where temperatures can dip to freezing. But the ample rainfall keeps the landscape lush and green, with rolling hills, forested parkland, and breathtaking vistas.

Check out 16 places where you can retire on $1,500 per month:

https://internationalliving.com/places-where-you-can-live-on-as-little-as-1500-a-month/

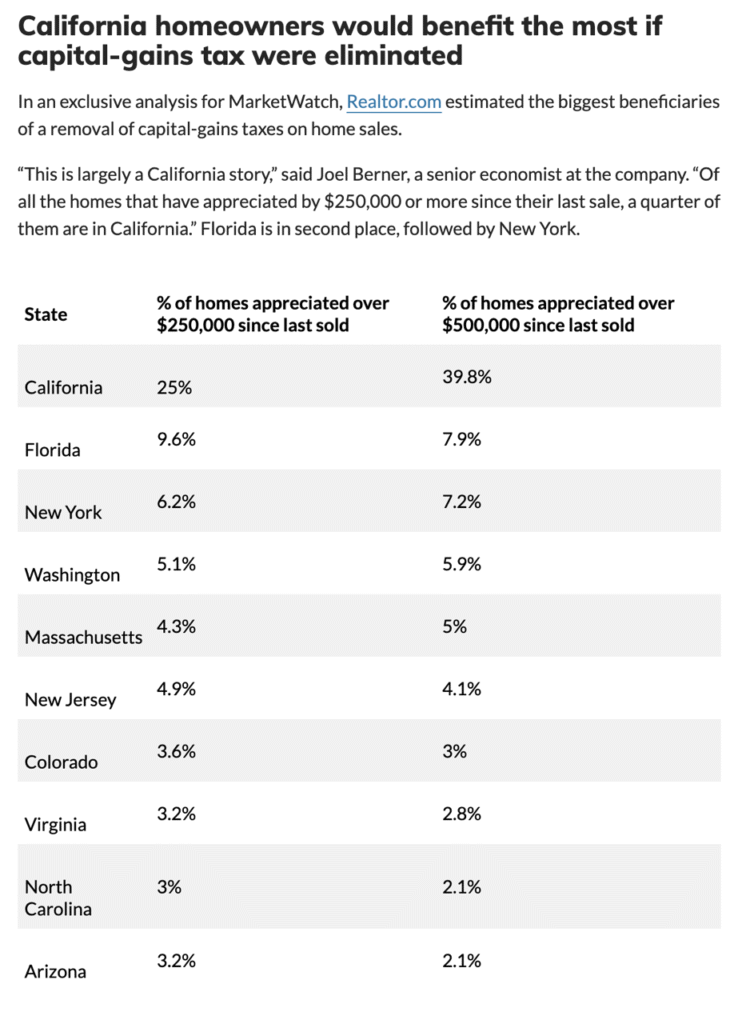

Virtually every homeowner around here would benefit greatly from the capital-gains tax being removed from home sales. Only those who bought in the last 3-4 years don’t have a $250,000+ gain already ($500,000 for married couples), but they bought their forever home and aren’t going anywhere. Virtually every NSDCC listing that was purchased prior to 2020 is priced at 50% over what they paid!

All that matters now is what Trump thinks about it:

President Donald Trump says he’s eyeing the elimination of capital-gains tax on home sales as a way to coax more people into selling their homes, amid a housing market that’s been frozen for nearly three years by high prices and high interest rates.

Oh great – aren’t the potential home sellers going to wait-and-see if this bill gets passed before listing their home for sale? Could this be what finally slows the surge of inventory?

First we had people (buyers and sellers) waiting for rates to go down, and now more sellers will want to wait for months or longer to list their home for sale.

An artificially-screwed up market….again!

Then once we know when the bill might pass, there will be a hyper-stimulated surge of new listings as sellers recognize that it will be better to get out early on this one. It’s going to be insane, and unlike anything we’ve ever seen before!

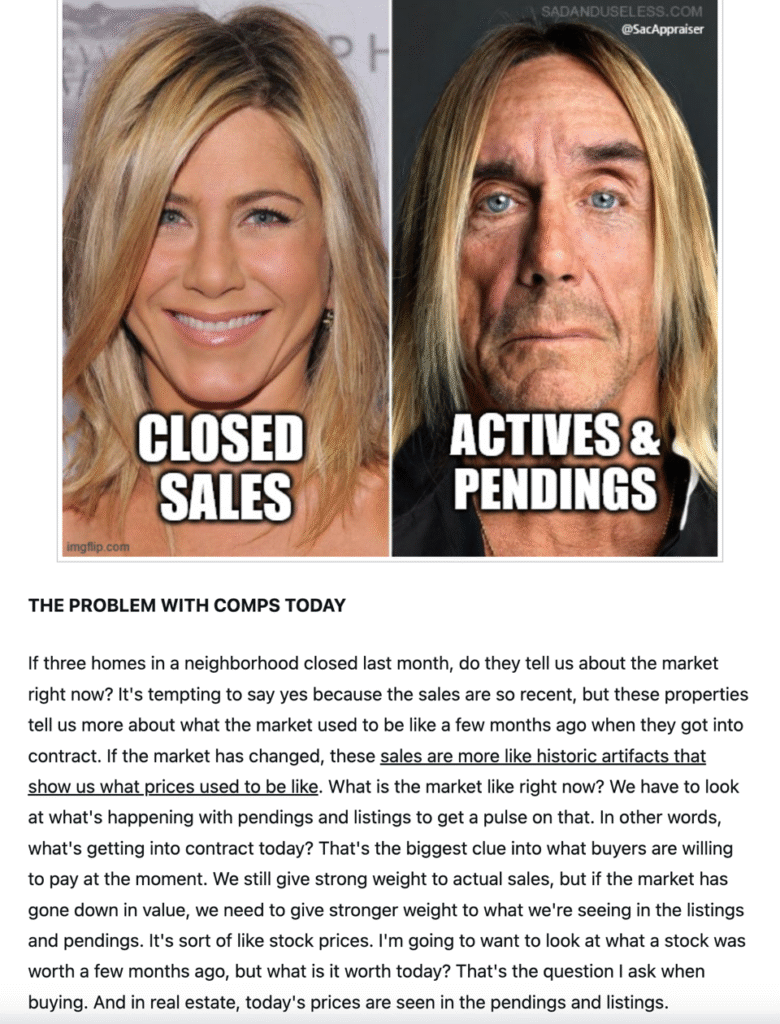

Hat tip to Ryan the appraiser for his great tips on how to use comps today. It’s a real problem when we have a hot 1st quarter and then sellers and listing agents want to use those comps for the rest of the year like they are hard facts on what a home is worth today:

https://sacramentoappraisalblog.com/2025/07/24/the-problem-with-comps-in-todays-housing-market/

You can also follow Ryan on twitter:

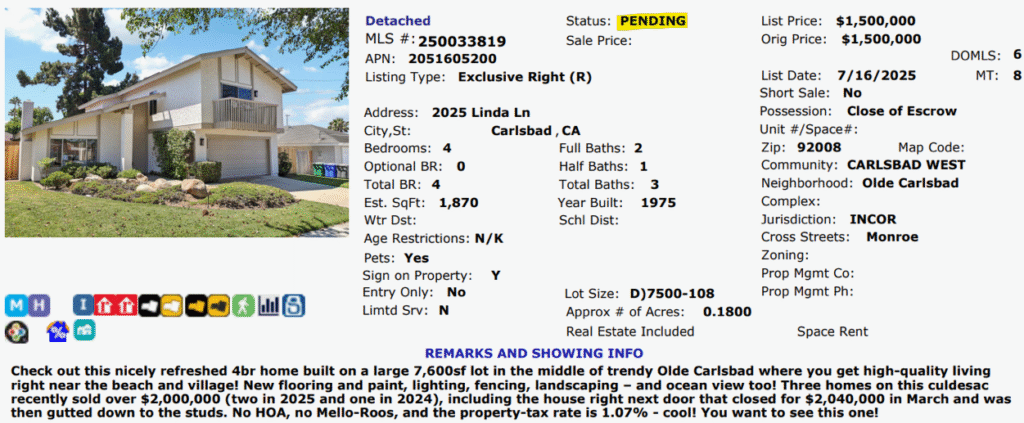

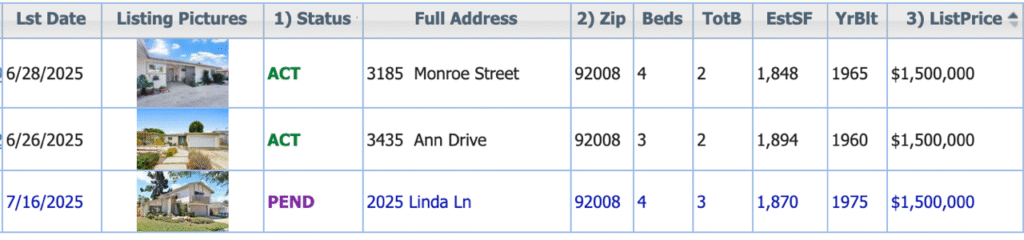

Two other active listings within a block of ours on Linda Lane had reduced their price to the same $1,500,000 so it was a real horse race over the last week. We were the only two-story home, but we had the best yard, and thankfully, we were the first ones to get into escrow!

The buyer-agent is an old friend and we’ve done SIX other deals together, the most of any other agent in history and she is bringing up her daughter in the business too. It didn’t mean anything to anyone else, but I slept better last night!

https://www.compass.com/listing/2025-linda-lane-carlsbad-ca-92008/1887446643870527721/